4 Undervalued Wide-Moat Consumer Cyclical Stocks

Big names including Etsy and Nike are trading at discounts.

Consumer cyclical stocks are on a bounce in 2023 after ending 2022 at a discouraging low. Despite the sector’s strong comeback, there are still long-term investing opportunities to be found. High-quality names such as Nike NKE and Harley-Davidson HOG are trading at significant discounts.

“Despite macro headwinds and near-term uncertainties, there are ample opportunities to invest,” writes Erin Lash, director of consumer sector equity research for Morningstar Research Services. “The Morningstar US Consumer Cyclical Index outperformed the broader market in the second quarter, exceeding the market’s 5.4% by 260 basis points. The median stock within the consumer cyclical sector trades at an 18% discount to our fair value estimates, with 52% of our coverage trading in 4- or 5-star territory.”

The Consumer Cyclical Index rose 28.1% in 2023 through Aug. 24, while the Morningstar US Market Index rose just 16.4%.

Morningstar US Consumer Cyclical

What Are Consumer Cyclical Stocks?

This sector includes retail stores, automobile and auto parts manufacturers, restaurants, lodging facilities, and entertainment companies. Firms in this sector include Amazon.com AMZN, Home Depot HD, and Starbucks SBUX.

Undervalued High-Quality Consumer Cyclical Stocks

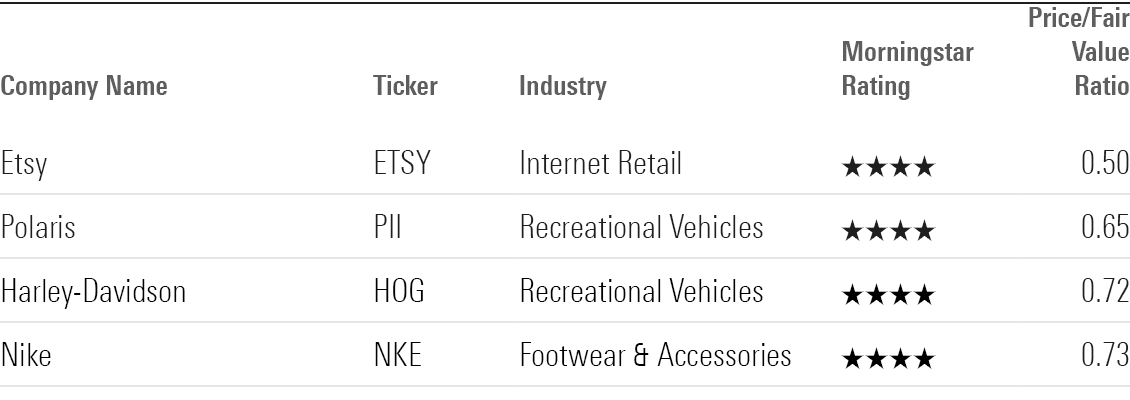

For this screen, we looked for the most undervalued stocks in the Consumer Cyclical Index with a Morningstar Rating of 4 or 5 stars. As of Aug. 24, 44 stocks met this criteria. Next, we filtered that list for stocks that have also earned a Morningstar Economic Moat rating of wide, meaning they have durable competitive advantages that are expected to last at least 20 years. Stocks with moats and low valuations historically tend to outperform over the long term.

Here are four undervalued wide-moat consumer cyclical stocks:

The most undervalued stock is Etsy, trading at a 50% discount to its analyst-assessed fair value estimate. The least undervalued is Nike, trading at a 27% discount.

Undervalued Consumer Cyclical Stocks

Etsy

- Fair Value Estimate: $145.00

“Etsy is a top-10 e-commerce operator in the United States and the United Kingdom, with sizable operations in Germany, France, Australia, and Canada as well. The firm dominates an interesting niche, connecting buyers and sellers through its online marketplace to exchange vintage and craft goods. The firm has cemented itself as one of the largest players in a quickly growing space, generating revenue from listing fees, commissions on sold items, advertising services, payment processing, and shipping labels.

“We view Etsy’s competitive strategy as sound, with the quickly growing firm capitalizing on a surge of COVID-19-induced demand, providing one of a handful of outlets through which customers could purchase face masks during the nadir of the pandemic. Though mask sales have dwindled, the platform has remained sticky, with Etsy seeing its consolidated active buyer base swell to 95 million at the end of 2022—roughly level with 2021 figures and more than double its pre-pandemic figure. As the marketplace leans into brand marketing to increase its unprompted awareness, invests in platform search functionality and filtering, and reduces purchase friction with its buyer protection program and better platform policing, we see a viable route to mid-single-digit growth in average annual per-buyer spend over the decade to come.”

—Sean Dunlop, equity analyst

Polaris

- Fair Value Estimate: $171.00

“Polaris designs and manufactures off-road vehicles, including all-terrain vehicles and side-by-side vehicles for recreational and utility purposes, snowmobiles, and on-road vehicles, including motorcycles, along with related replacement parts, garments, and accessories. The firm entered the marine market after acquiring Boat Holdings in 2018, offering exposure to new segments of the outdoor lifestyle market.

“Polaris is one of the longest-operating firms in power sports. We believe its brands, innovative products, and lean manufacturing yield a wide economic moat and that the company stands to capitalize on its research and development, solid quality, operational excellence, and acquisition strategy.

“With supply chain constraints continuing to ease, we expect 2023 should see further improvement in market share, as the availability of certain products improves. We think the ongoing restoration of modest prior market share losses ahead will signal the firm’s competitive edge is intact.”

—Jaime M. Katz, senior equity analyst

Harley-Davidson

- Fair Value Estimate: $46.50

“Harley-Davidson is a global leading manufacturer of heavyweight motorcycles, merchandise, parts, and accessories. Harley-Davidson Financial Services provides wholesale financing to dealers, as well as retail financing and insurance brokerage services to customers.

“With a long history of manufacturing experience, Harley-Davidson has brand strength and a dealer network that give it a wide economic moat and a dominant position in the U.S. motorcycle market.”

—Jaime M. Katz

Nike

- Fair Value Estimate: $136.00

“Nike is the largest athletic footwear and apparel brand in the world. Key categories include basketball, running, and football (soccer). Footwear generates about two-thirds of its sales. Its brands include Nike, Jordan, and Converse. Nike sells products worldwide through company-owned stores, franchised stores, and third-party retailers. The firm also operates e-commerce platforms in more than 40 countries. Nearly all its production is outsourced to contract manufacturers in more than 30 countries.

“We think Nike’s strategies allow it to maintain its leadership position. Over the last few years, it has invested in its direct-to-consumer network while cutting many wholesale accounts. In North America and elsewhere, the firm has reduced its exposure to undifferentiated retailers while increasing its connections with a small number of retailers that bring the Nike brand closer to consumers, carry a full range of products, and allow it to control the brand message. Nike’s consumer plan is led by its Triple Double strategy to double innovation, speed, and direct connections to consumers. The plan includes cutting product creation time in half, increasing membership in Nike’s mobile apps, and improving the selection of key franchises while reducing its styles by 25%.”

—David Swartz, senior equity analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)